As legislated in March 2022, Australian Reinsurance Pool Corporation (ARPC) launched the Cyclone Reinsurance Pool (cyclone pool) on 1 July 2022, to help reduce insurance premiums on home, commercial and strata for eligible properties in cyclone-prone regions. The cyclone pool covers wind, storm surge and flood.

ARPC’s new purpose is ‘protecting Australian communities with sustainable reinsurance for terrorism and cyclone’ and our new vision is ‘to support insurers to deliver affordable terrorism and cyclone insurance in Australia’.

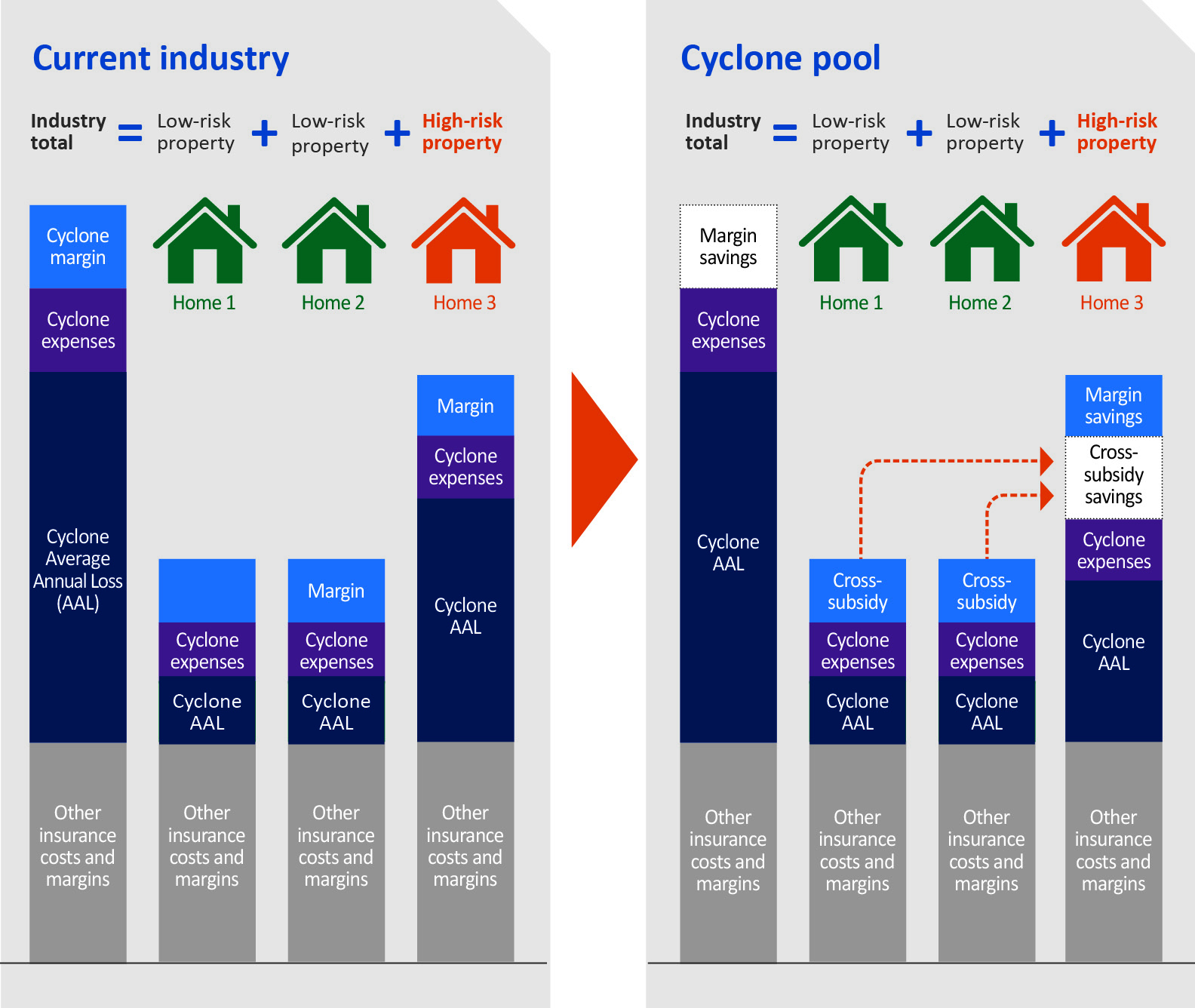

The cyclone pool is designed to lower insurance premiums for households and small businesses with high cyclone and related flood damage risk by reducing the cost of reinsurance, which is a significant cost component of premiums for these policies.

Australia’s competition regulator, the Australian Competition and Consumer Commission will monitor the premiums that insurers charge consumers to ensure savings are passed through to policyholders.

The cyclone pool is a reinsurance arrangement between insurers and ARPC, so pool customers are Australian insurers. Consumer policyholders, for example homeowners with insurance policies, are not required to join the pool.

The cyclone pool operates Australia wide, but targets support to cyclone-prone areas, which are primarily located in northern Australia.

Insurers must join the pool

Insurers must reinsure the risk of claims for eligible cyclone events by joining the pool and purchasing cyclone reinsurance from ARPC.

Large insurers with household gross written premiums of A$300m ($190m) or more must join the cyclone pool before 31 December 2023. Small insurers with household gross written premiums under A$300m have until 31 December 2024 to join the cyclone pool.

Risks covered

The cyclone pool covers cyclone and cyclone-related flood damage. This includes wind, rain, rainwater, rainwater run-off, storm surge and riverine flood damage caused by a cyclone.

The cyclone pool will cover claims for cyclone and cyclone-related flood damage arising during a cyclone event, which lasts from the time a cyclone begins until 48 hours after the cyclone ends – this is known as the cyclone event period.

Declarations

Australia’s weather agency, the Bureau of Meteorology (BoM) will observe the date and time when a cyclone begins and ends, and in some cases re-intensifies. Based on the BoM notification, the ARPC must then declare the start or end of a cyclone. The declaration will be on ARPC’s website

http://arpc.gov.au

Policies included in the pool

The cyclone pool covers home, strata and small business policies. This includes:

- Residential home and contents, including landlord insurance and farm residential cover

- Residential strata, including mixed-use strata schemes (where 50% or more of floor space is used mainly for residential purposes - or the commercial component is less than A$5m)

- Commercial property policies with less than A$5m total sum insured across risks covered by the pool (property, contents, and business interruption), and

- Small medium enterprises (SME) up to a maximum A$5m sum insured limit.

Funding the pool

The cyclone pool is funded by charging reinsurance premiums to insurers, consistent with the pool’s expected claims and operating expenses. The reinsurance pricing formula uses property data, such as geography, building characteristics and mitigation. The pool does not seek to make a profit, so increases potential savings to insurers and policyholders and is designed to:

- Lower the reinsurance cost for most policies with medium-to-high exposure to cyclone risk. (See Figure 1.1 for more information)

- Maintain incentives for risk reduction and offer discounts for properties that undertake mitigation, and

- Encourage policyholders to engage in strategies to mitigate cyclone and related flooding risks, while the discounts will assist to improve affordability and sustainability of property insurance over time.

| Figure 1: How the cyclone pool cross subsidises high risk properties |

|

|

Source: 2022 Cyclone Reinsurance Pool: Summary of the Actuarial Premium Rate Assessment – Finity Consulting Pty Ltd

|

Government support

The cyclone pool is supported by an annually reinstated A$10bn government guarantee. Any shortfall in reserves will be paid for through the government guarantee. If the A$10bn guarantee is likely to be exceeded by a single cyclone event or series of cyclone events within a single year, the government will increase the guarantee to help the cyclone pool meet its obligations.

Claims

Claims against the cyclone pool will be reimbursed to the insurer as per their reinsurance agreement with ARPC. The reinsurance agreement reimburses claims on eligible pool contracts in line with the insurers’ underlying policy terms and conditions (detailed in their product disclosure statement). The agreement also allows for insurers to seek recovery on claims handling expenses.

Processing

To support introduction of the cyclone pool, ARPC has launched a new reinsurance premium system called PACE. Insurers will lodge their premium and claims files through this portal, which will also include initial validation and warnings to ensure quality submissions.

Revised pricing rates published

In October, ARPC published revised premium rates for the cyclone pool. The premium rates insurers will pay to the cyclone pool were revised after a consultation period on the initial rates was extended, with new rates to be effective as of 1 October 2022.

As a result of additional information being provided by insurers, A$776m in projected annual premiums will now be collected by the cyclone pool.

Lower premiums paid by insurers to the cyclone pool will ultimately result in lower premiums for consumers.

Savings are expected to be higher in northern Australia than in other areas, consistent with the policy intent behind the cyclone pool and the way the premium rates have been designed. In addition, policyholders currently paying the highest premiums should also see the greatest savings.

The pricing formula means ARPC and the pool remain committed to:

- Being cost neutral to government over the longer term

- Not charging a profit margin, thereby increasing savings available to policyholders and insurers

- Lowering the reinsurance cost for most policies with medium-to-high exposure to cyclone risk

- Maintaining incentives for risk reduction and offer discounts for properties that undertake mitigation and

- Encouraging policyholders to engage in strategies to mitigate cyclone and related flooding risks, while discounts improve affordability and sustainability of property insurance over time.

The rates will come into effect for larger insurers that write home, strata, or SME insurance in cyclone-prone regions no later than 31 December 2023, and for smaller insurers no later than 31 December 2024. Consumers should see premium savings after that, as they renew their insurance.

The responsibility for setting insurance premiums stays with insurers and they are responsible for commercial decisions on how they set them. A

Dr Christopher Wallace is chief executive of Australian Reinsurance Pool Corporation.

|

We look forward to welcoming insurers when they join the cyclone pool.

|