The Singapore International Reinsurance Conference returned as an in-person event this year and welcomed over 2,000 delegates to its various conference halls, meeting rooms and exhibition booths. This period marks a challenging time for the industry, and experts from across the world came together to share what more the (re)insurance industry could be doing.

The reinsurance industry in Asia had a challenging year with geopolitical conflicts and inflation, but Singapore remains confident of a positive outlook for the sector. Asia continues to urbanise as the movement from rural to urban centres happen faster than in many other regions. The continent’s middle class is also growing and both consumption and production are increasing in response.

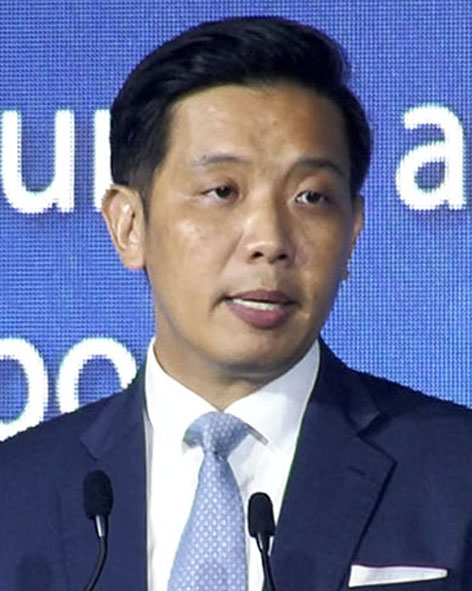

“In 2025 gross written premiums for life and non-life insurance are expected to grow to S$60bn ($42.4bn) and S$20bn respectively. As a result, more lives, wealth and assets will need protection. These growth trends will benefit Singapore’s insurance industry, given our role as a reinsurance centre. The reinsurance industry has also grown very deep roots in Singapore over the past five years,” said Singapore minister of state for trade and industry and MAS board member Alvin Tan, during his welcome address at SIRC.

A hub for specialty insurance and ILS

Mr Tan said Singapore continues to be a specialty insurance hub in Asia and the country has started to grow its capabilities to newer types of risks such as cyber. Cyber insurance, however, remains a nascent market in Asia compared to other regions like Europe and North America.

“We are seeing more insurers establish cyber underwriting desks and resources for Asia, right here in Singapore. We have cultivated our reinsurance market growth and debt capital markets capabilities by establishing Singapore as a domicile for insurance-linked securities (ILS),” he said.

Singapore has supported 22 ILS in the form of catastrophe bond issuance across the US and Asia Pacific. Despite market uncertainties from COVID-19, he said the ILS deals reflects a growing familiarity and confidence in Singapore’s ILS regime.

Reinsurers must ‘stop the self-flagellation’

At the leadership roundtable on the first afternoon, Allianz member of the board of management Christopher Townsend urged the industry to ‘stop the self-flagellation’ and remember that insurance does a lot of good for the world. He brought up Lloyd’s insuring the grain coming out of Ukraine while in the midst of the war, the industry’s efforts in rebuilding Florida after hurricane Ian caused $74bn of losses and trade credit insurance that ‘is the oxygen for free trade’.

“We are really hard and self-critical, and we hear it at every event. We do a ton of good as a society, we just don’t do enough to explain what we do,” he said.

This is no reason to rest on its laurels, as he also insisted that the industry could do better. “The difference between insured losses and economic losses is not getting better. Insurance penetration over the last decade has flatlined. We are the poorest industry in terms of digitalisation and I think we’re woeful in terms of cyber,” he said.

“We have a lot more to do, but as an industry, I think we have to band together more in terms of explaining what we do for society. Risk has never been more at the front of everyone’s agenda.”

Race to net zero

In an address before a plenary session on transitioning to net zero, Swiss Re CEO reinsurance and group executive committee member Moses Ojeisekhoba said the industry had “a significant role to play in trying to bring about the pledges that many companies around the world have made around net zero, whether the goal is to reach net zero by 2050 or 2060”. Referencing a recent study by Swiss Re Institute, he said that investments of up to $273bn will be needed for companies to reach those goals.

During the session, however, Bain & Company partner and head of APAC financial services practice Henrik Naujoks brought up how the insurance industry still lags in its net-zero commitments. Only 35% of the top 20 insurers have made net-zero commitment through to 2050, compared to 85% for the top 20 banks.

Zurich Resilience Solutions, Asia head of distribution, customers and growth Audrey Walls also pointed out that while there are over 20 members in the NetZero Insurance Alliance (NZIA), they still represent only 14% of global GWP.

Reinsurers could be doing more. She highlighted how most NZIA members are insurers and called for more reinsurers to lend support to the organisation.

Swiss Re head life and health products Asia, managing director Karen Tan said that insurance is not a straightforward business with underwriting activities that go through many layers upstream and downstream.

She talked about how the NZIA has been working with the Partnership for Carbon Accounting Financials (PCAF) to look at how insurers can make change happen.

At the very foundation of it all, measurements are required. “What gets measured gets done,” she said. “The NZIA is working together with the PCAF very closely to figure out how we can measure the carbon emissions coming from underwriting activities. And they have a proposal that is due to be disclosed or shared more widely, and with the intention of being finalised towards the end of this year.

“This is a concrete action. We first need to get to measurements before we can talk about targets, because when we don’t have a consistent measurement, a commitment is just a commitment. That’s why people talk about lip service because you can find it anywhere you want.”

The era of structural disinflation is definitely over

During a plenary session focused on global inflation and the implications for the (re)insurance industry, The Geneva Association deputy managing director, head of research and foresight Kai-Uwe Schanz asked how long inflation would last - before going on to highlight the cyclical drivers of inflation that ranged from the aftermath of the pandemic to current dislocations in global energy and food markets.

These pressures need to be contrasted with the structural drivers of inflation that include deglobalisation, decarbonisation and demographic shifts, he said.

Dr Schanz made it clear that we must consider the effects of inflation and rising interest rates as being two quite separate drivers – and emphasised that the effects of each will be very different on both the life and the non-life sectors. The core areas of focus are claims, reserves and expenses on one hand and lapses, margins and sales on the other.

He then turned his attention to focus on how the insurance value chain should respond to these pressures and identified the areas to be addressed as product design, marketing, underwriting/ pricing/reserving, distribution, claims, customer service and investments.

APAC

In Asia, the focus would be more on interest rates and exchange rates where, according to Swiss Re Institute chief economist Asia John Zhu, “central banks will be very active”. There is an expectation that rate hikes will continue into the middle of 2023 and probably beyond.

His view was that “China is a very special and interesting case” because weakness in consumer demand has stifled inflation but when demand picks up, the result will be inflation that will peak in mid-2023. A