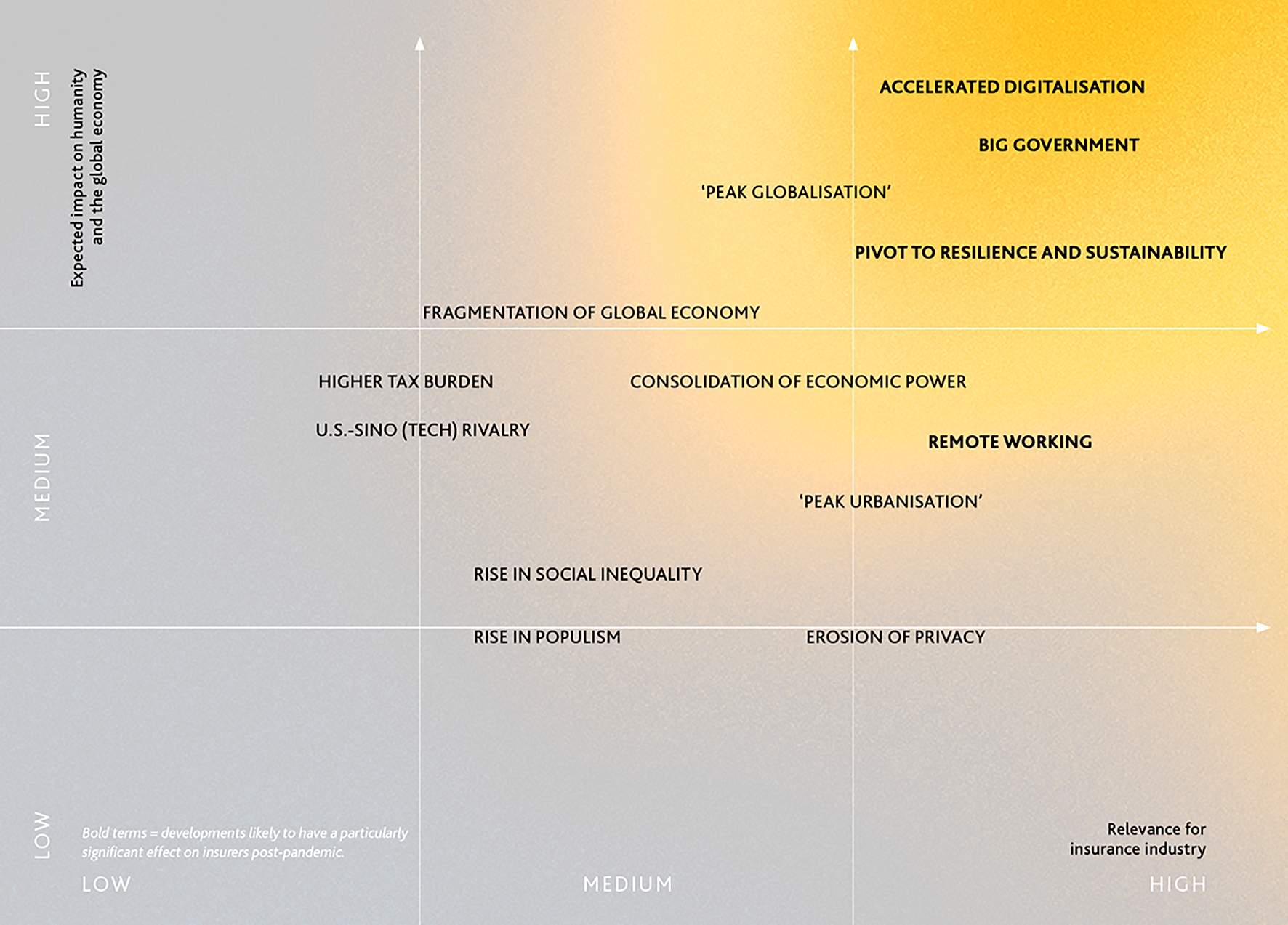

Based on in-depth interviews, a global customer survey, and desk research, The Geneva Association tried to forecast what the post-pandemic risk landscape might look like, factoring in changes to the political, economic, social and technological environment, in its latest report. Based on this baseline scenario, accelerated digitalisation, ‘big government’, increased sustainability and the shift to remote working – in that order – are projected to have the most significant effects on insurers and their role in the post-pandemic world.

Figure 1: Relevance of the baseline scenario for the insurance

|

| Source: The Geneva Association |

Accelerated digitalisation

The pandemic has hastened and amplified digitalisation and will accelerate consumers’ embrace of e-commerce – for good. This offers new opportunities for insurers and their customers but also entails risks.

Big government

Governments have assumed a vital, unprecedentedly active role during the COVID-19 crisis and temporary and unconventional emergency stimulus measures may well become permanent. This may negatively impact insurance demand by fuelling the perception that governments will intervene and provide disaster assistance in the event of a truly disastrous pandemic. To alleviate rapidly growing sovereign debt, governments might be tempted to condone higher levels of inflation, with adverse consequences for insurers.

Pivot to resilience and sustainability

COVID-19 has exposed protection shortfalls that affect people’s livelihoods, lives and health. For insurers, this represents a major opportunity to build resilience by addressing protection gaps for three major insurable risks faced by society: Natural disasters, premature death and catastrophic spending on healthcare.

Remote nature of work

Increased remote working has implications for companies’ risk exposures in various areas and requires amendments to existing insurance coverages. The shift is expected to reshape the advance of urbanisation, with greater differentiation between cities that are merely aggregations of economic activity and genuinely smart cities where people choose to live. We may also see a protracted period of higher social inequality.

The voice of insurance customers – findings from a global survey

The Geneva Association conducted a global survey of 7,200 retail and 800 small commercial insurance buyers in Brazil, China, France, Germany, Italy, Japan, the UK and the US. Findings include:

- Over 50% of retail and commercial respondents believe that remote working, the shift to digital and increased social inequality are the trends that are most likely to endure post-pandemic.

More than a third of small business owners expect supply chains to shift towards more local suppliers.

- Almost two thirds of retail customers are concerned about a higher risk of extended hospitalisation and a loss of income or wealth. For small business owners, furloughing employees, a deteriorating financial position of the business and the need to close down rank highest among post-pandemic concerns.

- More than 40% of retail customers consider health and life insurance as more important post-pandemic, though only a fifth intend to buy (additional) coverage. More than 50% of small business owners value business interruption (BI), group life and health, and liability insurance more highly; just over a quarter expressed their intention to purchase (additional) insurance.

- Retail and small commercial customers expect more comprehensive policies to cover future unknown disruptions, clearer and simpler policy wordings, and more prevention services. Small business owners expect more comprehensive BI policies.

- Almost 90% of both retail and commercial respondents with at least one insurer interaction reported a positive experience with their insurers during the pandemic. This bodes well for insurers’ perception as a competent and reliable partner in meeting customers’ post-pandemic risk management and protection needs.

Long-term strategic implications for insurance

COVID-19 has demonstrated the fragility of modern life. This is set to translate into higher awareness of risk and existing protection gaps and, therefore, increased demand for risk cover. This could go hand-in-hand with higher expectations from the public and private sectors on issues such as financial exclusion. Therefore, insurers should redouble their efforts to narrow protection gaps.

Heightened risk awareness post-pandemic could offer a fertile ground for promoting risk solutions, but insurers will also need to simplify their offerings successfully. Insurers must seize the opportunities offered by accelerated digitalisation and develop more affordable, accessible and appealing products and solutions.

The pandemic has reinforced the pivot to sustainability across businesses and society. In light of the massive societal imbalances caused by the pandemic, insurers will have to pay more attention to the social dimension of ESG. More generally, the pandemic has prompted a re-evaluation of the division of risk among individuals, employers and the state. This could herald a new chapter for the welfare state and the role of private-sector insurance in complementing it. For insurers, these trends are a double-edged sword; a heightened appreciation of the value of resilience and sustainability should help them to more compellingly carve out their corporate purpose. On the other hand, the pandemic has demonstrated the extent to which governments can smooth shocks. If social inequality and redistribution remain at the top of the political agenda, insurers will need to enter into a more pro-active dialogue with ‘big government’ on their contribution to what appears to be a new social contract.

Heightened awareness of vulnerability has led to a rise in mindfulness. For insurers, this shift offers additional opportunities to expand traditional business models predicated on paying claims and benefits to broader and more engaging customer propositions such as prevention services. Insurers can harness technology to expedite the transition to more customer-oriented business models fitting the post-pandemic risk landscape. IoT literacy and the understanding of its translation into insurance prevention services need to be strengthened. The development of data-driven and technology-based prevention services should be treated as a business transformation rather than an isolated project. The economics of prevention services need to be recognised as different from payment-oriented models so they are commercially viable.

Due to COVID-19, the way insurers work, the way they organise their core processes and the way they interact with their clients have changed for good. The rapid acceleration of digitalisation brought about by the pandemic is a major opportunity for insurers to achieve greater speed, scale and simplicity, in terms of IT, product landscape, business processes and customer interaction. Those who succeed in decreasing time to market, digitalising the value chain, boosting productivity, trimming cost and personalising customer interactions will be among the winners. At the same time, especially in life insurance, the ‘hybrid customer approach’ is likely to remain most promising.

COVID-19 has demonstrated that the economic losses from a global pandemic are uninsurable. For some risks there is a gap between what insurers are able to insure and what clients and society expect them to cover. In order to avoid false expectations, insurance contracts have to be much more simple and accessible so that customers know which risks are covered. A

Dr Kai-Uwe Schanz is deputy managing director and head of research and foresight with The Geneva Association.