Solar, hydropower, wind, geothermal, biomass – as the energy and renewables markets rapidly evolve across AsiaPacific, Nat CAT events, driven by climate change, threaten infrastructure and carry significant production impacts. In response, innovations within the insurance sector are helping tap into additional reinsurance capacity and fill coverage gaps left by the traditional insurers. Increasingly mainstream, parametric insurance provides coverage opportunities for the full life cycle of renewable energy projects – from financing or delayed start-up risks, through to operational exposures.

Mr Robert Drysdale and

Mr Ben Qin of

Descartes Underwriting explain how.

As one of the fastest-growing regions in the world, Asia Pacific’s energy demand is projected to increase by as much as 70% by 2040. Notably, continued growth and a heavy dependence on coal remains, however. According to the International Energy Association, coal demand has doubled in the last decade. Coal represents 73%, 59% and 56% of the electricity generation mix in India, Indonesia and Australia respectively, and 58% of total electricity consumed in China.

To balance the region’s projected energy demand with ambitious climate targets set by member states, the share of renewable sources in the region’s power sector needs to be rapidly scaled up. Thankfully, many countries agree that significant investment in renewable energy is crucial in order to secure a clean energy transition that limits global warming to 2°C. Government initiatives, such as 20-year-feed-in-tariffs with quality counterparties, have also shown positive signals. In 2018, an estimated $150.2bn was invested in renewable energy in the region and cumulative solar photovoltaic capacity is expected to triple to 35.8 gigawatts by 2024.

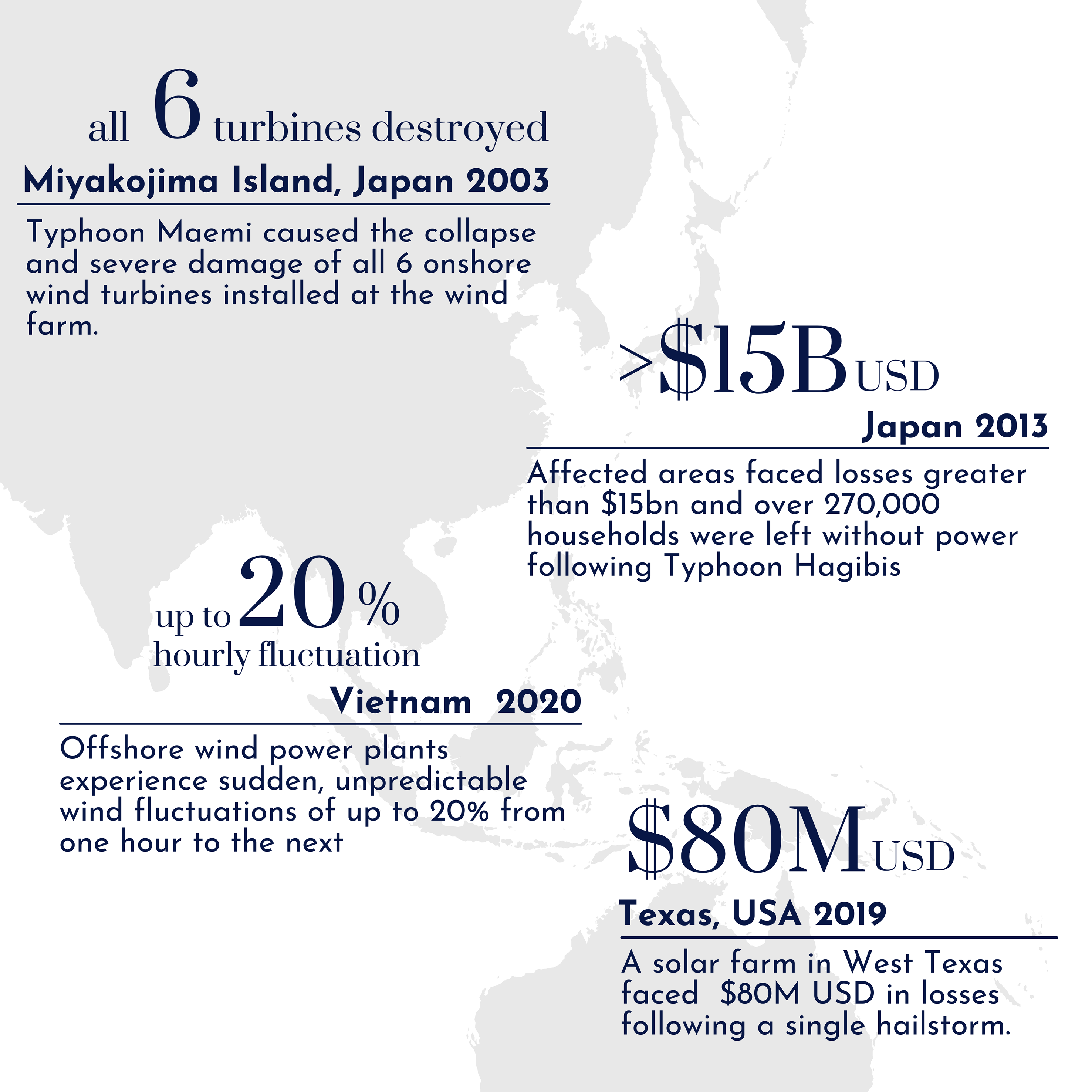

Continued market hardening, Nat CAT exposures and climate change, however, all pose non-negligible threats that hinder investment and the continued development of the renewables sector in Asia Pacific. Recent loss examples – including the collapse and severe damage of all six wind turbines installed at a wind farm on Miyakojima Island in Japan following typhoon Maemi, or the $80m in losses for a solar farm following a single hail event in 2019 in West Texas – underscore the need for a revolutionary approach in insurance to protect renewable energy investments and assets better.

| How it works

Unlike traditional insurance, which relies on lengthy loss-adjustment procedures, parametric insurance pays out when a predefined event (e.g., flood, cyclone, earthquake) occurs as measured by a specified parameter or index such as rainfall, wind speed or peak ground acceleration. Driven by objective data and real-time monitoring from ground-based sensor technologies, radar and satellite imagery, parametric insurance provides a means to guarantee liquidity via swift and direct pay-out, following a qualifying event. This new generation of products complements or replaces traditional insurance at a more affordable premium that fits within contracting budgets, not on-top. With no on-the-ground loss adjustment required, a parametric cover keeps cost low while offering precise protection.

|

Insuring renewable energy – challenges and opportunities

Renewable energy projects face different risks throughout their life cycle. This dynamic risk exposure can contribute to a complex insurance environment that necessitates detailed knowledge and understanding from all players involved, from developers and contractors to investors and insurers.

- Project funding: Renewable power generation is dependent upon natural resources that are uncontrollable by human activity, at times limiting their use or efficiency. Wind fluctuations, lack of water resources, solar radiation shortfalls and demand volatility due to mild winter can all lead to revenue variability. Because of this inherent intermittency, renewable projects are often considered somewhat risky by investors and can face difficulties in securing financing.

Parametric solutions offer insurance against renewable yield volatility by linking renewable energy input to the price per unit of asset dependent output. Customised precisely to client’s production locations, turbine or power generation technology, and historical yield – parametric covers protect against loss of income due to an excess or lack of natural resource through a straightforward, index-based solution that triggers based on objective, third-party data.

- Start-up delays: Disruptions, delays and business interruption caused by meteorological risks (strong typhoons, inclement weather) represent a significant exposure for renewables projects. This issue is even more acute for offshore projects as they face special challenges related to the aggressive maritime environment.

Take for example the construction delays experienced by a wind farm developer due to high wind conditions. While the client had budgeted 20 days of weather delay in an already tight six-month schedule, wind conditions left cranes inoperable or forced postponement of lifts to a resource-constrained night schedule. Acting as a financial hedge, parametric covers can be structured to pay out when weather conditions reach certain thresholds that will impede operations – providing developers certainty of liquidity to help cover additional costs.

- Lack of historical data: Offshore or on land, natural hazard coverage for the renewable energy sector has proven to be a challenge for traditional insurance. A lack of historical claims data makes this challenge particularly acute. Advances in technology related to the reporting and detection of Nat CAT and weather-related events enable parametric insurance risk models to improve underwriting capabilities significantly.

With a growing and extensive product offering against all Nat CAT perils impacting renewable energy projects, parametric insurance provides a means to supersede gaps in the traditional marketplace and better protect Asian markets and businesses against climate change. A

Mr Robert Drysdale is head of Southeast Asia and Mr Ben Qin is head of North Asia and Australia with the Descartes Insurance Asia and Australia divisions.

|

Offshore wind yield and typhoon exposure, filling gaps in the traditional marketplace

Challenge: Wind generation output can fluctuate by 20% from one hour to the next, leading to substantial annual variations in yield and revenue. An offshore wind company developing a new site in Taiwan faces typhoon exposure as well as future cash flow uncertainty due to inherent wind volatility. The wind farm must purchase insurance as part of the terms set by its financing parties. This includes proof that the new site will be covered against loss of revenue due to lack of wind resource. The traditional market does not offer coverage for lack or excess of wind, thus the company must find an alternative solution in order to continue construction.

Parametric solution: The wind farm opts for a dual-trigger parametric policy that pays out when power generation does not meet pre-agreed thresholds, or when a typhoon surpasses a particular wind speed at asset locations. The swift pay-out enables business continuity and guaranties an economic balance towards all financing parties. Exposure of the offshore site is monitored in real-time by satellite data. The policy is customised precisely to the wind farm location, exposure, and turbine technology, and structured based on decades of data. This reduces project risk and leads to increased profit security.

|

| High hail exposure for solar development in remote area of Australia

Challenge: A PV plant was recently developed at a remote location where existing hail data maps lack precision due to poor data availability. The traditional market responded by imposing high deductibles and reduced limits after similar PV plants suffered losses in 2019 due to equipment damage and subsequent business interruption following a tennis ball sized hails across Queensland.

Parametric solution: Regardless of where a given solar farm is located, technology advances related to the reporting and detection of hail events (e.g., doppler radar, satellite imagery, on-site sensors, etc.) enable parametric insurance providers to more accurately model and underwrite hail risk. The parametric approach also incorporates asset-specific factors and models the underlying phenomenon directly, rather than pricing policies based on limited historical loss data. This overcomes shortfalls in the traditional marketplace, minimizes basis risk, and provides renewable clients with swift pay-out and fairly priced coverage that most closely represents their experience during a hailstorm.

|