The resurgence of inflation in late 2021 came as a surprise, if not a shock. It arose from the continued aftermath of the COVID-19 pandemic and was followed by sharp energy and food price increases as a result of Russia’s invasion of Ukraine in late February 2022.

Three other, more structural forces could make inflation ‘stick’, even if central banks succeed in taming the current episode during the course of 2023: Decarbonisation and the need for massive capital expenditure on green energy as well as higher carbon prices; deglobalisation and the trend towards supply-chain reshoring and increasing protectionism; and demographic changes, as ageing populations will require more public expenditure on health and elderly care and may cause shortages in labour supply.

Impact on insurers

Most life insurance products, e.g. mortality, wealth accumulation and longevity protection, offer benefits that are nominally fixed. Having said this, inflation tends to erode the value proposition of life insurance with fixed benefit payouts, weighing on new business and leading to higher lapses.

Lower equity markets, rising interest rates and widening credit spreads adversely affect insurers’ balance sheets through mark-to-market valuation losses. On the other hand, higher interest rates, i.e., discount rates, have a favourable effect on the net present value of future liabilities.

How should insurers respond?

There is a wide range of management actions insurers can take to respond to the new macroeconomic environment (Table 1). In terms of product design, with customers typically suffering a reduction in real income, insurers could offer more affordable, low-cost products with an increased focus on risk and loss prevention.

With tight labour markets and increasing wage pressure, insurers will also maintain their drive to improve operational cost efficiency and overall productivity. Digitalisation is one obvious route to achieve this objective in areas such as distribution (the biggest non-claims cost block), marketing and customer service.

The main underwriting response is to reprice insurance risks that exhibit elevated claims costs.

To counter rising claims costs, insurers may further accelerate claims automation and straight-through processing as well as expand (or build) partner and supplier networks to negotiate fixed prices for a longer period of time.

In investment management, there is some scope for inflation protection on the back of tactical asset allocation, for example by tilting the investment portfolio away from bonds towards commodities, equities and real estate. For insurers, however, such benefits remain elusive in light of very high solvency capital requirements for those asset classes.

Potential opportunities for insurers

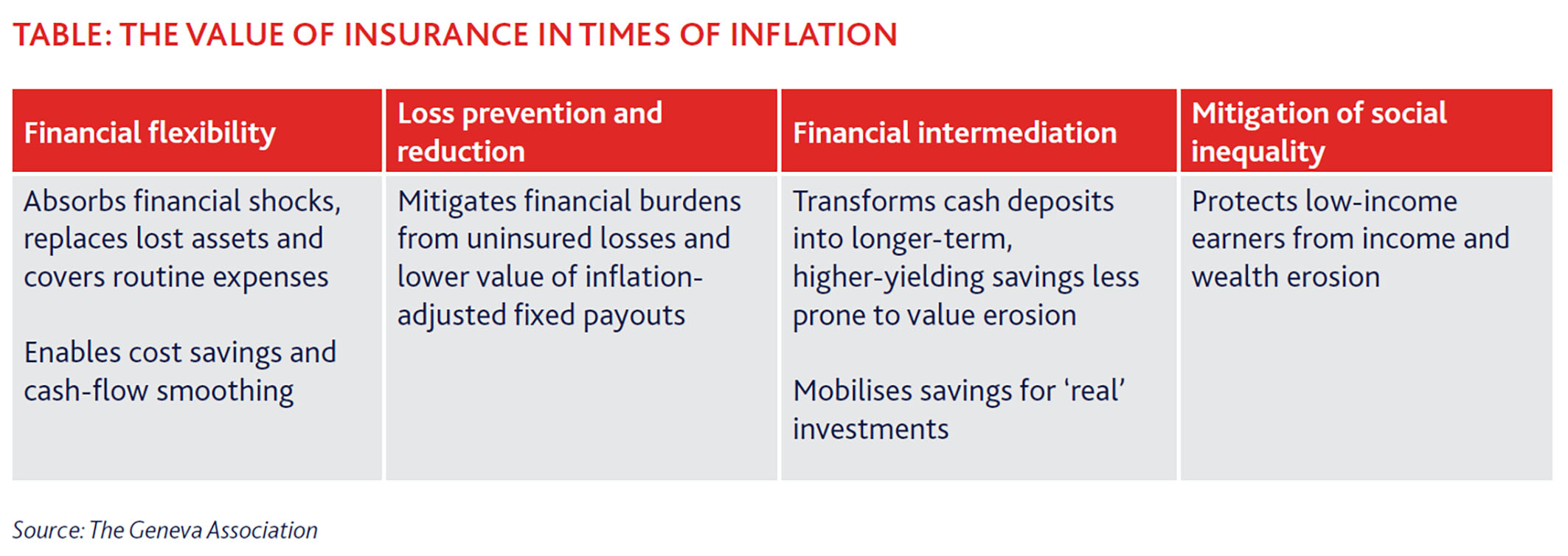

Inflationary episodes typically entail lower economic growth or even recessions, which hurt demand for insurance, especially when considered as a non-essential item. However, for customers and society at large, the value of insurance increases in times of inflation, for the following reasons (Table 2):

- Customers’ reduced financial flexibility during an inflationary shock adds to the relevance of financial protection and stability afforded by insurance coverage. In periods of inflationary recession, insurance customers are likely to attach a particular value to the ‘peace of mind’ derived from insurance.

- The role of insurance in loss prevention and reduction is especially relevant as individuals, households and businesses would face a higher financial burden from any uninsured losses and a lower inflation-adjusted value of fixed payouts. Based on their risk data and expertise, insurers have a competitive edge in prevention-oriented risk assessment and control.

- In the absence of price stability, insurers’ traditional role in financial intermediation further gains in importance. Life insurers in particular can help transform individuals’ and households’ short-term (cash) deposits into longer-term, higher-yielding savings, which are less prone to value erosion than deposits.

- By stabilising the financial situation of individuals and households, insurance also contributes to mitigating social inequality. As long as insurance is in place and affordable, vulnerable people are less exposed to falling (back) into poverty following a financial shock exacerbated by a sudden surge in inflation.

Going forward, demand for insurance could benefit from the shock experience of resurging inflation. Such shocks – similar to what we witnessed as a result of COVID-19 – typically affect risk perception and sharpen risk awareness.

Demand for non-life insurance could also benefit from portfolio shifts from financial to real assets. Furthermore, increasing prices of real assets such as cars and property translate into higher demand for insurance as asset owners seek to expand policy limits.

For life insurance, inflation presents particular challenges as it erodes the value of future fixed pay-outs, making in-force life insurance products less attractive, adversely impacting sales and increasing lapses and surrenders.

Demonstrate the value of insurance in times of shock

The pandemic strengthened the risk awareness of individuals, households and businesses. Insurers continued to pay legitimate claims in a ‘business-as-usual’ manner. Demand for life and health insurance products in particular has surged and remains structurally above pre-pandemic levels, especially in emerging markets.

Protect profitability and solvency

For non-life insurers in particular, inflation and subsequent increases in interest rates generate adverse impacts on earnings and net-asset value. Remedial action, ranging from product redesign, repricing and cost management to changes to the asset allocation, is inevitable in order to be able to offer lasting and reliable risk protection.

Respond to changing customer needs in light of inflation

Customers have woken up to the risk of unexpected rampant inflation. Insurers’ perceived value going forward may therefore also depend on their ability to manage inflation risk on behalf of their customers. Evolving customer expectations may give rise to changes to product design.

Adjust solvency regimes to reflect the new macroeconomic realities

With normalising interest rates, there is now clear customer appetite for the protection offered by financial guarantees. Prohibitive risk capital charges for such guarantees, set during an extended period of interest rate declines, ultimately hinder the insurance industry from tackling the pension savings gap. A

Dr Kai-Uwe Schanz is head of research and foresight and director socio-economic resilience with The Geneva Association and Mr Pieralberto Treccani is research support manager with The Geneva Association.