How were all these factors driving 2023 renewals? (Pricing, retention, portfolio pricing and risk appetite)

Reinsurers become pricing-driven in light of hard retro and lower dedicated capital

Due to unrealized investment losses and the absence of new capital, reinsurers and retrocessionaires tend to deploy their capital strictly to risks with adequate pricing.

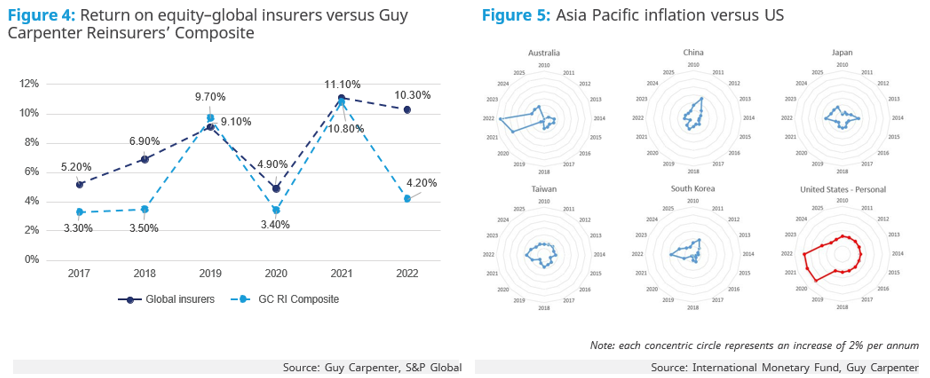

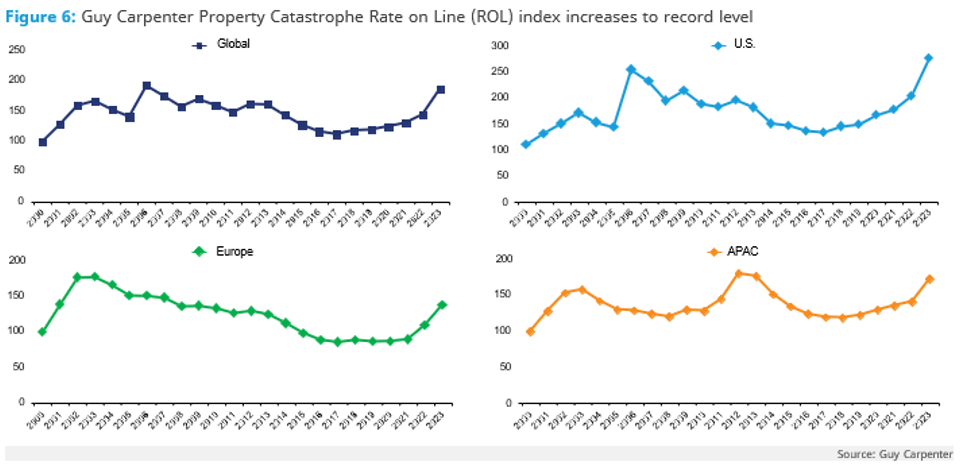

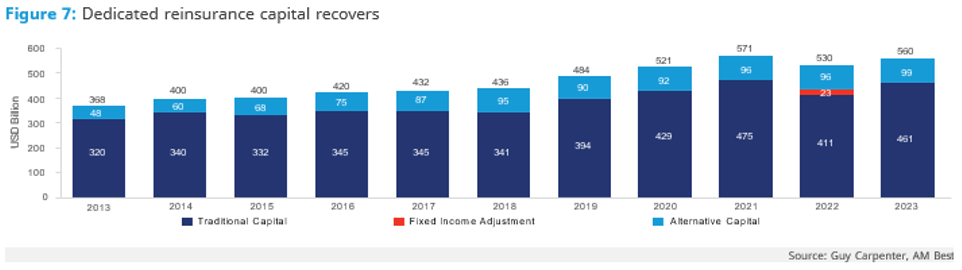

Dedicated reinsurance capital declined by 12% in 2022, with traditional capital falling 13.5% on an absolute basis. It is expected to bounce back over the course of 2023 due to earnings improvement, but is still likely to only reach 2021 levels. Despite stable retrocession market capacity, the cost and level of attachment rose in the January 1 renewals, with reinsurers taking on more risk. Global property catastrophe pricing increased by ~28% during January renewals, while, on average, Asia Pacific property catastrophe pricing increased by 15%-20% on a risk-adjusted basis. This was driven partly by higher retrocessional costs. In view of high inflation and interest rates, it is expected that reinsurers will continue to prioritize adequate risk pricing for sustainable combined ratio improvement across all lines and regions, particularly on long-tail business.

Insurers are forced to retain more risk on their own books in response to the hardening market

Lower layers are typically priced at higher ROLs to reflect the higher probability and frequency of losses, constituting the largest cost portion of the property excess of loss program. These are where the dollar impact of industrywide price hardening is most prominent.

Decreased capacity from the retro market has reduced available reinsurer capacity that can be provided to the insurance market. As a result, insurers have had to increase their retention to partially offset the impacts of rising costs and decreased capacity.

Nearly one-third of Asia Pacific programs had increased their retention toward 1-in-10 years (from previously 1-in-5 years on average), leaving insurers with decreased earnings protection for catastrophe losses at the lower return period.

What does it mean for (re)insurers?

Insurers should expect higher volatility on their return on equity

As insurers increase their retention, they expect to retain all lower-return-period catastrophe losses previously ceded to reinsurers. However, considering heightened climate risk, increasing occurrences of non-peak perils events could leave insurers more susceptible to increased catastrophe loss retention. Without adequate rate movements and proper risk selection in underwriting processes, this could potentially jeopardize insurers’ capital. Retaining more risk may also limit an insurer’s ability to pursue growth opportunities, as more capital may be required to support increased (catastrophe- related) risk exposure.

Uncertainty remains whether reinsurers’ ROE will exceed their cost of capital, despite improvement

Improvements in pricing adequacy will help reinsurers improve underwriting profitability, as illustrated in their catastrophe loss ratios. These changes are largely in line with the upward ROL trend. Additionally, the unwinding of unrealized losses on matured fixed-income securities coupled with higher investment yield will gradually improve reinsurers’ return on equity (and their shareholders’ equity position).

In the past 6 years, global reinsurers’ average ROE (~6%) stayed below their cost of capital. Higher interest rates have increased the cost of capital, from ~8% in 2020 to above 11% in the first half of 2023. It is still too early to tell if the earnings improvement in the first half of this year (before the hurricane/typhoon season began) will become a sustainable trend, as if pricing improvement is adequate to counter the more frequent and severe catastrophic losses in view of climate change. Also, the rebound on investment return remains uncertain, given the current environment of high inflation and interest rates. A more concrete shift in the pricing cycle can be achieved only when reinsurers are earning sustainable returns higher than their cost of capital consistently, in order to allow for more flexible reinsurance pricing and attract more capacity.

How Guy Carpenter Can Help

Guy Carpenter’s model development team focuses on non-peak perils, such as flooding, hail and other perils that lack credible vendor models. All models are fully probabilistic and include the ability to examine specific climate change scenarios. These models are used globally by our clients for reinsurance pricing, risk management, portfolio management, capital allocation and regulatory requirements.

The trend of increased retention and increased price will likely continue until the ROE becomes substantial enough to attract new capacity. Insurers should continue to investigate alternative risk transfer arrangements, such as:

- Structured solutions: The implementation of structured features can address capital and solvency problems, increase efficiency and volatility management and manage growth.

- Parametric covers: By paying pre-established costs according to the characteristics of a particular physical event, parametric solutions remove the need for a prolonged adjustment process.

- Portfolio management: The alignment of a firm’s capital management framework with a catastrophe modeling output enables targeted returns, allowing firms to re-underwrite the “worst offenders” in their existing portfolio and select new areas for growth.

- Government pools: Guy Carpenter has been involved in designing and delivering several natural catastrophe and terror international pooling schemes, decreasing volatility for insurers.

Guy Carpenter has teams dedicated to each of these areas.

Click here to read the full briefing.